Sign in

Create an AccountPlease login to access this website.

Terms of Service

TERMS OF SERVICE

Last updates : 25th March, 2024, at 09:30

1- CONTRACT BETWEEN YOU AND UFOODIN

The contract between you and uFoodin is starting when you register your account on our website/App. By using our services, you accept the whole conditions of this Terms of Service. The contract is covering all our Services, as uFoodin website and App.

This contract is valid for Members & Visitors

You can visit our Privacy & Cookies Policy concerning all the information about the Data collection, data use, and shared personal information.

When you have filled our Registration form, and click on “Create Account”, you accept to conclude this contract that engaged you legally.

If you are not agreeing our Terms of Service Conditions, do not click on “Create Account”.

If you decided later to stop this contract and not use anymore our Services, you only need to Close your account.

uFoodin reserved the right to modify this Terms of Service Conditions, Privacy & Cookies Policy at any time. You will be informed directly by our platform or by email.

The modification will be sent before the effective date, and let you the time to close your account if you not agreeing the modifications.

By continuing to use our Services will automatically signify you agree the modifications, once it is taking effect.

2- YOUR OBLIGATIONS

2.1- Contract & Account

By concluding this contract, you warranty the following items:

– You are 18 years old minimum

– You are in capacity to conclude this contact

– You have never been banned by uFoodin to use its Services

– You need to have only one uFoodin account with you real name

– You need to use your real information and not create a fake account

– Your account should be use only by you, you are responsible of your own account:

• Choose a strong password and keep it personal

• You cannot share a part or the full use of your account to another person: its mandatory to respect the law and our Terms of Services Conditions

2.2- Payment

When you purchase one of our Membership Services or Ads Placement on uFoodin website/App, you need to pay it, accept your payment data are stored with us. You also accept to pay the potential the VAT added in your services. VAT depending of your location, if you are a Personal or Company purchaser.

For any Refund, please refer to our Refund Policy

If you purchase our Membership Services or Ads Placement Service and the payment is cancelled or decline, we will stop immediately your access to the Membership Services or Ads Placement bought. You also accept in function of your location to take in charge all type of transaction fees.

We keep your payment information to let continue, without interruptions your Services in the case of Monthly Payment Plan, or Annually Prepaid Plan. You can choose to do not renew the Services at the end of the contract and stop the Contract Renewal in advance, from your Purchases Account. You can check all previous purchase from My Purchases Page.

2.3- Communication

You accept we communicate with you by different way: by e-mail, mobile number, messages on uFoodin website/App, notifications. You can update your contact information at any time in your account.

2.4. Information

You can choose in your Account, your Privacy and Profile visibility, to limit or not the access to your information by other members or visitors.

All information shared on our Services can be view, share and copy by other member or visitors.

uFoodin is not have the obligations to publish any content on the website, and can delete content, post at any time.

2.5- Additional Obligations – To do on uFoodin

uFoodin ask to all members to respect the rules of website/App community, defined by our Community Policy and the following ones:

2.5.1 By agreeing this contract, you have to:

– Communicate only exact information’s and update it if there is any change

– Use your real identity to register an account and use our Services,

– Use our Services professionally

– Respect all uFoodin rules, including the law of privacy protection, tax laws and regulatory requirements, intellectual property law, unsolicited email laws, and export control laws.

2.5.2 – By agreeing this contract, you do not have to:

• Create a false identity to use our Services, or create an account for another person

• Communicate information you do not have the right to communicate (e.g. personal data of someone)

• Communicate any information of uFoodin without our consent

• Hijack our security systems

• Develop or use any kind of software as scripts, bots, to web scraping our Services, or copy our data, members on our Services, or add / download contacts or send / receive messages.

• Violate any intellectual property of others and the ones of uFoodin, as patents, trademarks, copyrights or others intellectual properties.

• Post any virus, or any dangerous code

• Try to obtain source code of uFoodin and our Services, by any way

• Declare to other you are affiliate or sponsored by uFoodin, without our consent

• Monitor our performances and functionalities for competitive purposes

• Sale our services, or agree any kind of contract with others on our Services, without our consent

• Disrupt our Services operation by any way

• Violate our Community Policy

3- YOUR RIGHTS

3.1- About your information

All your information published in our Service are your own property. You have choice to make its Visible or Not by others on your Account Settings. You grant a non-exclusive the world right to uFoodin for this information:

- Information can be transferable, with a sub-licenses allowed for the use, modification, copy, distribution, publication, content and data processing provided on our website/App Services, without any additional consent, remuneration and notice to you.

These rights are restricted:

- You can cancel this license for a specific content to delete the content on our Service, or Close simply your Account, unless others have share, copy, or stored these information’s, we need a reasonable time to delete the content

- We do include your content in our Ads Placement Services without your consent. Except you purchase our Service Ads Placement). We keep the right to place Ads around your content and data, without your consent and remuneration.

- If we want to share/give your data to other parties, we will ask you previously your consent. If you decide to publish post in “Public”, other members can integrated the post in their “Public” post, the content may be accessible by other parties

- We can modify your content or layout (for translation purposes for example), but we never change the meaning of it.

All your personal data are subject of our Privacy Policy

If you submit suggestions on our Services through our Contact Form, you accept we share and use it for any purpose without financial compensation.

You are engaged to communicate only the information’s and content you are in right to share. All these information and content should be real, and not break the law or violate personal rights.

3.2- About our Services

At any time, uFoodin can modify Services Prices for the future, modify, suspend or stop a Services. In all cases you will be informed in a legal deadline.

The data may not be any more stored on our Services, but you can ask a copy of all your Data here.

3.3- Third Parties & Members

Third Parties and members may publish offers of products, services, jobs, advertising, and uFoodin is not responsible of their sales and marketing. We are not responsible of their activities. If their content is not legal, exact, partial, differed, or confusing, uFoodin is not responsible.

uFoodin cannot review all the content publish on the platform (website/App). You recognize by the accepting this Terms of Service conditions, uFoodin is not responsible of the content and information of members, third parties, and uFoodin is not caution of them, even uFoodin recommend you a member Service or Product, through Ads or Widgets. If you are a member who offers Product or Services, you recognize to have all necessary license and right to do it on uFoodin. uFoodin is also not responsible of Events listed on the platform.

3.4- Restrictions for abused behavior

In case of non-respect of the uFoodin rules, we can restrict you for the Network connection with others, (e.g. too many Connection request in small imparted time). If we consider you are still not respect other rules, defined by the Community Policy of uFoodin, we can close or suspend your account at any time.

3.5- Data

uFoodin use your data to suggest you some content as Product Offers, Job Offers, Ads. You can read the Privacy & Cookies Policy to know more about it.

3.6- Intellectual Property Rights

uFoodin has a full right on its brand, logos, name, business membership logo as registered trademark

4- DISCLAIMER AND LIMITATION OF LIABILITIES

uFoodin and its subsidiaries do not gives warranty and reject responsibility on:

-

- Services interruption or Services Error, including all content and information from our Services, while respecting the law applicable.

- Warranty of data accuracy, absence of counterfeiting, of merchantable quality or for a particular purpose

- uFoodin and its subsidiaries exclude all responsibilities on this contract (in the respect of the law) on :

- Your potential profit lost

- Your Business opportunities lost

- Your tarnished reputation

- Your data lost, modify, update of use of our Services (in case of by a technical issue on our Services and Website/App)

- Other all potentials indirect damages

uFoodin and its subsidiaries should have no responsibility to you or with this contract for an amount greater than 1000 EUR (including all fees) for the period of this contract payable to us or to you.

This negotiation base and exclusions are between you and us, and are applicable on all potential request of compensation (e.g. civil liability, warranty, negligence)

All these previous restrictions are not valid in case of fraud, willful misconduct, gross negligence, death, personal injury, or negligence due to breach of a material duty, an obligation substantial enough to warranty it make the prerequisite for providing services and on which you can reasonably rely, but only to the extent that the damage was caused directly by the breach and was foreseeable at the conclusion of this Agreement and to the extent that it is typical in the context of this Agreement.

5- CONTRACT TERMINATION

Both parties are able to decide to terminate this contract at any time. Once the termination is done, you lose all your access and use right to our uFoodin Services.

Only the following stipulations continue to survive after the contract termination:

-

- Rights of Members and Visitors to continue to reshare the content you shared on our Services

- Sums due to uFoodin or to you

- The restrictions described in the section 4- Disclaimer and limitation of liability

- Your Obligations in the paragraph 2.6

6- B2B MARKETPLACE

Definition:

Seller : is uFoodin Members who selling its products/services on uFoodin Marketplace

Buyer : is uFoodin Members who buying products/services on uFoodin Marketplace

uFoodin : is the intermediate that facilitate the transactions between Seller and Buyer by offering the Marketplace system integrated on uFoodin platform.

Escrow Account : means the escrow account for the facilitation of all payments made via uFoodin Platform and Marketplace transactions.

Transaction fees : are the fees take on the global amount of each Transactions made between a Seller and Buyer. Fees are deductible of the global amount transaction. It mean the Seller will received the the Transaction global amount, minus the Transaction fees percentage indicate on this Term Of Service

![]() Starter Seller : Verified Seller by uFoodin and Mangopay in term of KYC and KYB

Starter Seller : Verified Seller by uFoodin and Mangopay in term of KYC and KYB

![]() Silver Seller : Verified Seller by uFoodin and Mangopay in term of KYC and KYB

Silver Seller : Verified Seller by uFoodin and Mangopay in term of KYC and KYB

![]() Gold Seller : Verified Seller by uFoodin and Mangopay in term of KYC and KYB

Gold Seller : Verified Seller by uFoodin and Mangopay in term of KYC and KYB

![]() Gold-LC Seller : Verified Seller by uFoodin in term of KYC and KYB

Gold-LC Seller : Verified Seller by uFoodin in term of KYC and KYB

6.1- Seller Subscription :

Seller subscription on uFoodin Marketplace:

-

Seller need to purchase the Business Membership on uFoodin in order to sell the products/services on the uFoodin Marketplace.

-

Trial Period Terms for Business Memberships :

All types of business memberships—Starter, Silver, Gold, and Gold-LC, whether on monthly plans—include a 14-day trial period. This trial can be used only once per company. If a person from a company attempts to utilize the trial period multiple times by registering for different plans or membership levels, uFoodin reserves the right to cancel the trial period at any time. Additionally, uFoodin reserves the right to ban the user account and the associated company.

-

The uFoodin Business Membership is not refundable, even the verification of the compliance process is rejected by our service. The reason of the rejection could be, but not limited to:

-

Document unreadable

-

Document not accepted

-

Document expired

-

Document incomplete

-

Document missing

-

Document does not match user data

-

Document falsified

-

Underage person

-

Specific case

-

Legal proceedings against the company or its manager

-

Seller need to provide all documents List below to be verified by our service (for Starter, Silver, Gold & Gold LC Seller with a Monthly, Annually & Lifetime plan) – Here is the KYC/KYB official link where are diplayed the documents to provide to uFoodin for the full Seller Account validation on uFoodin B2B Marketplace : KYC/KYB Page – Below find the basic list of minimum documents to be provided to uFoodin:

o Company owner ID

o Company Registration proof

o Company Shareholder declaration

o Company Articles of Associations

-

Once the documents are verified and accepted by our service (within 7 working days if all documents are valids), the seller will be informed by email the validation. If needed, uFoodin could ask more document to complete the verification. Seller will immediately get access of the full functionalities of the marketplace.

Verification documents (KYC/KYB) must be submitted in one of the following languages: French, English, German, Dutch, Spanish, Italian, and Portuguese. (Except Passport & Bank Account Information)

If a document is not available in one of the above languages, an official translation in French or English will be required. The Legal team may ask for the official translation of a document if deemed necessary.

6.2- Responsibility of each parties (Seller/Buyer/uFoodin)

6.2.1- Seller Party :

-

Seller is responsible for the quality of products/services delivered

-

Seller is the only responsible for the delay of the production and on indemnity caused due to the delay of utilization of the products/services by the buyer. The claim will be done by the buyer to seller directly.

-

Seller should put in its Seller dashboard the company information in the settings for each new product added on the marketplace.

-

Seller is responsible for choosing the correct VAT/Sales taxes/GST rate regarding the seller’s country regulation (if applicable) depending on the products/services the seller sells.

-

If the Seller need to establish a contract between the buyer and the seller company, the contract should include the commission fees of the escrow payment.

6.2.2- Buyer Party

-

Buyer is responsible for verifying the specification of the products/services before to buy

-

Buyer is responsible for paying the amount indicated on the sales contract

6.2.3- uFoodin Party :

-

uFoodin is only an intermediate between buyers and sellers, all issues regarding the delivery delay, quality issues of the products / services supplied and cancellation of the order by buyer/seller are not part of the responsibility of uFoodin

6.3- Purchase/Sell Policies :

6.3.1. Seller doesn’t indicate its own policies :

There is two case figures :

1st case figure: Cancellation before the payment of the buyer on the escrow account. Cancellation from the Buyer/Seller, no fees will apply on the cancellation.

2nd case figure: The party (buyer or seller) cancels the contract after payment of the buyer.

-

If the Buyer cancel the contract after its payment on uFoodin Escrow Account : 6% of the global amount will be retain, 5% for the Seller and 1% for uFoodin to cover Bank and Service fees

-

If the Seller cancel the contract after the buyer payment on uFoodin Escrow Account : 1% of the global amount will be retain for uFoodin to cover Bank and Service fee

6.3.2. Seller indicate its own policies

Seller can add its own policies on its store applicable for all its Product Offers, or add individually policies on each product offers. If the Seller add its own policies on the product offers, the ones of uFoodin in the paragraph 6.3.1 are not applicable.

6.4- Refund

If for some reasons the Seller need to refund partially or totally the buyer order, it will not be possible to do it through uFoodin Platform and our payment service. The Seller will need proceed to a direct bank wire to the Buyer Bank account. The transaction fees charged by uFoodin for this initial order are not refundable to the Seller.

6.5- Who is eligible to sell/buy products /services on uFoodin B2B marketplace.

Buyer and Seller from the countries list bellow are authorized to make transaction (sell or purchase) through uFoodin Marketplace :

210+ AVAILABLE COUNTRIES TO SELL AND BUY*

More countries will be added in the future

| AD – Andorra |

| AE – United Arab Emirates (the) |

| AG – Antigua and Barbuda |

| AI – Anguilla |

| AL – Albania |

| AM – Armenia |

| AO – Angola |

| AQ – Antarctica |

| AR – Argentina |

| AS – American Samoa |

| AT – Austria |

| AU – Australia |

| AW – Aruba |

| AX – Åland Islands |

| BA – Bosnia and Herzegovina |

| BB – Barbados |

| BD – Bangladesh |

| BE – Belgium |

| BF – Burkina Faso |

| BG – Bulgaria |

| BH – Bahrain |

| BI – Burundi |

| BJ – Benin |

| BL – Saint Barthélemy |

| BM – Bermuda |

| BN – Brunei Darussalam |

| BO – Bolivia (Plurinational State of) |

| BQ – Bonaire, Sint Eustatius and Saba |

| BR – Brazil |

| BS – Bahamas (the) |

| BT – Bhutan |

| BW – Botswana |

| BZ – Belize |

| CA – Canada |

| CC – Cocos (Keeling) Islands (the) |

| CG – Congo (the) |

| CH – Switzerland |

| CI – Côte d’Ivoire |

| CK – Cook Islands (the) |

| CL – Chile |

| CM – Cameroon |

| CN – China |

| CO – Colombia |

| CR – Costa Rica |

| CV – Cabo Verde |

| CW – Curaçao |

| CX – Christmas Island |

| CY – Cyprus |

| CZ – Czechia |

| DE – Germany |

| DJ – Djibouti |

| DK – Denmark |

| DM – Dominica |

| DO – Dominican Republic (the) |

| DZ – Algeria |

| EC – Ecuador |

| EE – Estonia |

| EG – Egypt |

| EH – Western Sahara |

| ES – Spain |

| FI – Finland |

| FJ – Fiji |

| FK – Falkland Islands (the) [Malvinas] |

| FM – Micronesia (Federated States of) |

| FO – Faroe Islands (the) |

| FR – France |

| GA – Gabon |

| GB – United Kingdom of Great Britain and Northern Ireland (the) |

| GD – Grenada |

| GE – Georgia |

| GF – French Guiana |

| GG – Guernsey |

| GH – Ghana |

| GI – Gibraltar |

| GL – Greenland |

| GM – Gambia (the) |

| GP – Guadeloupe |

| GQ – Equatorial Guinea |

| GR – Greece |

| GT – Guatemala |

| GU – Guam |

| GW – Guinea-Bissau |

| GY – Guyana |

| HK – Hong Kong |

| HN – Honduras |

| HR – Croatia |

| HT – Haiti |

| HU – Hungary |

| ID – Indonesia |

| IE – Ireland |

| IL – Israel |

| IM – Isle of Man |

| IN – India |

| IO – British Indian Ocean Territory (the) |

| IS – Iceland |

| IT – Italy |

| JE – Jersey |

| JM – Jamaica |

| JO – Jordan |

| JP – Japan |

| KE – Kenya |

| KG – Kyrgyzstan |

| KH – Cambodia |

| KI – Kiribati |

| KM – Comoros (the) |

| KN – Saint Kitts and Nevis |

| KR – Korea (the Republic of) |

| KW – Kuwait |

| KY – Cayman Islands (the) |

| LA – Lao People’s Democratic Republic (the) |

| LC – Saint Lucia |

| LI – Liechtenstein |

| LK – Sri Lanka |

| LS – Lesotho |

| LT – Lithuania |

| LU – Luxembourg |

| LV – Latvia |

| MA – Morocco |

| MC – Monaco |

| MD – Moldova (the Republic of) |

| ME – Montenegro |

| MF – Saint Martin (French part) |

| MG – Madagascar |

| MH – Marshall Islands (the) |

| MK – North Macedonia |

| MN – Mongolia |

| MO – Macao |

| MP – Northern Mariana Islands (the) |

| MQ – Martinique |

| MR – Mauritania |

| MS – Montserrat |

| MT – Malta |

| MU – Mauritius |

| MV – Maldives |

| MW – Malawi |

| MX – Mexico |

| MY – Malaysia |

| MZ – Mozambique |

| NA – Namibia |

| NC – New Caledonia |

| NE – Niger (the) |

| NF – Norfolk Island |

| NG – Nigeria |

| NI – Nicaragua |

| NL – Netherlands (the) |

| NO – Norway |

| NP – Nepal |

| NR – Nauru |

| NU – Niue |

| NZ – New Zealand |

| OM – Oman |

| PA – Panama |

| PE – Peru |

| PF – French Polynesia |

| PG – Papua New Guinea |

| PH – Philippines (the) |

| PL – Poland |

| PM – Saint Pierre and Miquelon |

| PN – Pitcairn |

| PR – Puerto Rico |

| PT – Portugal |

| PW – Palau |

| PY – Paraguay |

| QA – Qatar |

| RE – Réunion |

| RO – Romania |

| RS – Serbia |

| RW – Rwanda |

| SA – Saudi Arabia |

| SB – Solomon Islands |

| SC – Seychelles |

| SE – Sweden |

| SG – Singapore |

| SH – Saint Helena, Ascension and Tristan da Cunha |

| SI – Slovenia |

| SJ – Svalbard and Jan Mayen |

| SK – Slovakia |

| SL – Sierra Leone |

| SM – San Marino |

| SN – Senegal |

| SR – Suriname |

| ST – Sao Tome and Principe |

| SV – El Salvador |

| SX – Sint Maarten (Dutch part) |

| SZ – Eswatini |

| TC – Turks and Caicos Islands (the) |

| TD – Chad |

| TF – French Southern Territories (the) |

| TG – Togo |

| TH – Thailand |

| TK – Tokelau |

| TL – Timor-Leste |

| TN – Tunisia |

| TO – Tonga |

| TR – Turkey |

| TT – Trinidad and Tobago |

| TV – Tuvalu |

| TW – Taiwan (Province of China) |

| TZ – Tanzania, the United Republic of |

| UG – Uganda |

| UM – United States Minor Outlying Islands (the) |

| US – United States of America (the) |

| UY – Uruguay |

| VA – Holy See (the) |

| VC – Saint Vincent and the Grenadines |

| VG – Virgin Islands (British) |

| VI – Virgin Islands (U.S.) |

| VN – Vietnam |

| VU – Vanuatu |

| WF – Wallis and Futuna |

| WS – Samoa |

| XK – Kosovo |

| YT – Mayotte |

| ZA – South Africa |

| ZM – Zambia |

***India : Sellers based in India can not sell to other Indian Companies. Indian Sellers can export only. Indian Buyers can import only

***Brazil : Sellers based in Brazil can not sell to other Brazilian Companies. Brazilian Sellers can export only. Brazilian Buyers can import only

**United States of America : Buyers based in US need to provide a Tax Exemption Certificate to purchase your Product. The document is asked during the checkout. If the buyer can not provide it, the transaction is blocked.

6.6- Payment on the B2B Marketplace

6.6.1- Escrow Account Payment Service

All transactions between Buyer and Seller will pass through an Escrow account payment service operated by uFoodin, Unipessoal, Lda. Any funds will be held in a third-party escrow account and will only be released to the seller upon successful verification of all legal documents of the transactions, as for example: contract, bill of lading, packing list, and all other documents legal documents that proving the good achievement of the transactions, depending of the transactions situations and types.

Transaction fees applied for Gold Seller (Business Membership Lifetime, Annual, Month) : 1,5% of the global transaction amount (including VAT if applicable and Shipping Cost)

Transaction fees applied for Silver Seller (Business Membership Lifetime, Annual, Month) : 3% of the global transaction amount (including VAT if applicable and Shipping Cost)

Transaction fees applied for Starter Seller (Business Membership Lifetime, Annual, Month) : 5% of the global transaction amount (including VAT if applicable and Shipping Cost)

6.6.2- Letter of Credit

All the verification of the export documents, contracts and all attached documents of the order between the Buyer and the Seller will be verified by the respective banks of the Buyer and the Seller. uFoodin is not responsible of documents verifications for a payment made through Letter of Credit.

Transaction fees applied for Gold-LC Seller (Business Membership Lifetime, Annual, Month) : 0,3% fees of the global transaction amount (including VAT if applicable and Shipping Cost). The Seller will have until 60 days after the order passed by the Buyer to pay the 0,3% fees to uFoodin via the Seller Dashboard, button : “Pay LC Commissions”.

6.7 – Shipping

This policy requires that all sellers provide accompanying services, coordinated shipment or pickup of products at destination address or other incoterm concluded with the buyers. Failure to comply with this policy may result in a warning, suspension of the seller privileges.

Incoterm accepted on uFoodin, take in charge by the Seller :

CIF (Cost Insurance & Freight ) :

Seller’s Obligations

-

Goods, commercial invoice and documentation

-

Export packaging and marking

-

Export licenses and customs formalities

-

Pre-carriage and delivery

-

Loading charges

-

Delivery at named port of destination

-

Proof of delivery

-

Cost of pre-shipment inspection

-

Minimum insurance coverage

Buyer’s Obligations

-

Payment for goods as specified in sales contract

-

Discharge and onward carriage

-

Import formalities and duties

-

Cost of import clearance pre-shipment inspection

-

DAP (delivered at place)

Seller’s Obligations

-

Goods, commercial invoice and documentation

-

Export packaging and marking

-

Export licenses and customs formalities

-

Pre-carriage and delivery

-

Loading charges

-

Cost of pre-shipment inspection

-

Main carriage

-

Delivery to named place of destination

-

Proof of delivery

Buyer’s Obligations

-

Payment for goods as specified in sales contract

-

Unloading from arriving means of transportation

-

Import formalities and duties

-

Cost of import clearance pre-shipment inspection

-

Onward carriage and delivery to buyer (depending on named place)

-

FOB (Free on Board)

Seller’s Obligations

-

Goods, commercial invoice and documentation

-

Export packaging and marking

-

Export licenses and customs formalities

-

Pre-carriage and delivery

-

Loading charges

-

Delivery onboard vessel at named port of shipment

-

Proof of delivery

-

Cost of pre-shipment inspection

Buyer’s Obligations

-

Payment for goods as specified in sales contract

-

Main carriage

-

Discharge and onward carriage

-

Import formalities and duties

-

Cost of pre-shipment inspection (for import clearance)

-

DDP (Delivered Duty Paid)

Seller’s Obligations

-

Goods, commercial invoice and documentation

-

Export packaging and marking

-

Export licenses and customs formalities

-

Pre-carriage and delivery

-

Loading charges

-

Main carriage

-

Proof of delivery

-

Import formalities and duties

-

Cost of all inspections

-

Delivery to named place of destination

Buyer’s Obligations

-

Payment for goods as specified in sales contract

-

Assist seller in obtaining any documents or information necessary for export or import clearance formalities

-

CFR (Cost and Freight)

Seller’s Obligations

-

Goods, commercial invoice and documentation

-

Export packaging and marking

-

Export licenses and customs formalities

-

Pre-carriage and delivery

-

Loading charges

-

Delivery at named port of destination

-

Proof of delivery

-

Cost of pre-shipment inspection

Buyer’s Obligations

-

Payment for goods as specified in sales contract

-

Risk starting with onboard delivery

-

Discharge and onward carriage

-

Import formalities and duties

-

Cost of pre-shipment inspection (for import clearance)

-

FCA (Free Carrier)

Seller’s Obligations

-

Goods, commercial invoice and documentation

-

Export packaging and marking

-

Export licenses and customs formalities

-

Pre-carriage to terminal

-

Delivery to named place of delivery

-

Cost of pre-shipment inspection

-

Proof of delivery

Buyer’s Obligations

-

Payment for goods at price agreed upon in sales contract

-

Unloading from arriving means of transportation

-

Loading charges

-

Main carriage

-

Discharge and onward carriage

-

Import formalities and duties

-

Cost of pre-shipment inspection (for import clearance)

6.8- Communication Policy between Seller and Buyer

As a Service Provider of uFoodin Marketplace, and all the services around the marketplace, as the Instant Messaging, and Social Platform functionalities in general, unless we inform you in writing that you are exempt from this policy, Seller can only contact a buyer by using uFoodin communication channel such as instant messaging functionalities or an uFoodin app. Seller may not use buyer personal data to contact buyers customers in any way for marketing or promotional purposes.

6.9- What uFoodin is going to check

uFoodin will verify:

-

The documents related to the status of the seller’s company

-

Documents regarding the exportation (Packing list, Certificate of Origin, etc)

-

The shipping documents (Bill of Lading, Waybill, etc)

uFoodin is not responsible of the Content of the Export Documents and all certificate documents. If there is any writing error, that causing issues in the customs clearance or in the process of the exportation, the Supplier (the Original Seller) of the Product is the only one responsible of it.

Here are documents demanded per type of transportation used. Some products /services may have some exceptions and could be exempt of one or more documents demanded below.

Please note that uFoodin has right to ask more documents for further verification if there are suspected elements on the seller’s behavior or on the regarding transaction. Under no circumstances, uFoodin is responsible for delay or problem of shipping and quality issue or quantity issue of the product/service agreed by the seller.

-

Maritime

-

Proforma Invoice

-

Packing list

-

Certificate of Origin

-

Ocean Bill of Lading

-

Insurance Documents

-

Air cargo

-

Proforma Invoice

-

Packing list

-

Certificate of Origin

-

Air waybill

-

Insurance Documents

-

-

Inland transportation

-

Proforma Invoice

-

Packing list

-

Certificate of Origin

-

Inland Bill of Lading

-

Insurance Documents

-

-

Multimodal transport

-

Proforma Invoice

-

Packing list

-

Certificate of Origin

-

Combined Transport Bill of Lading

-

Insurance Documents

-

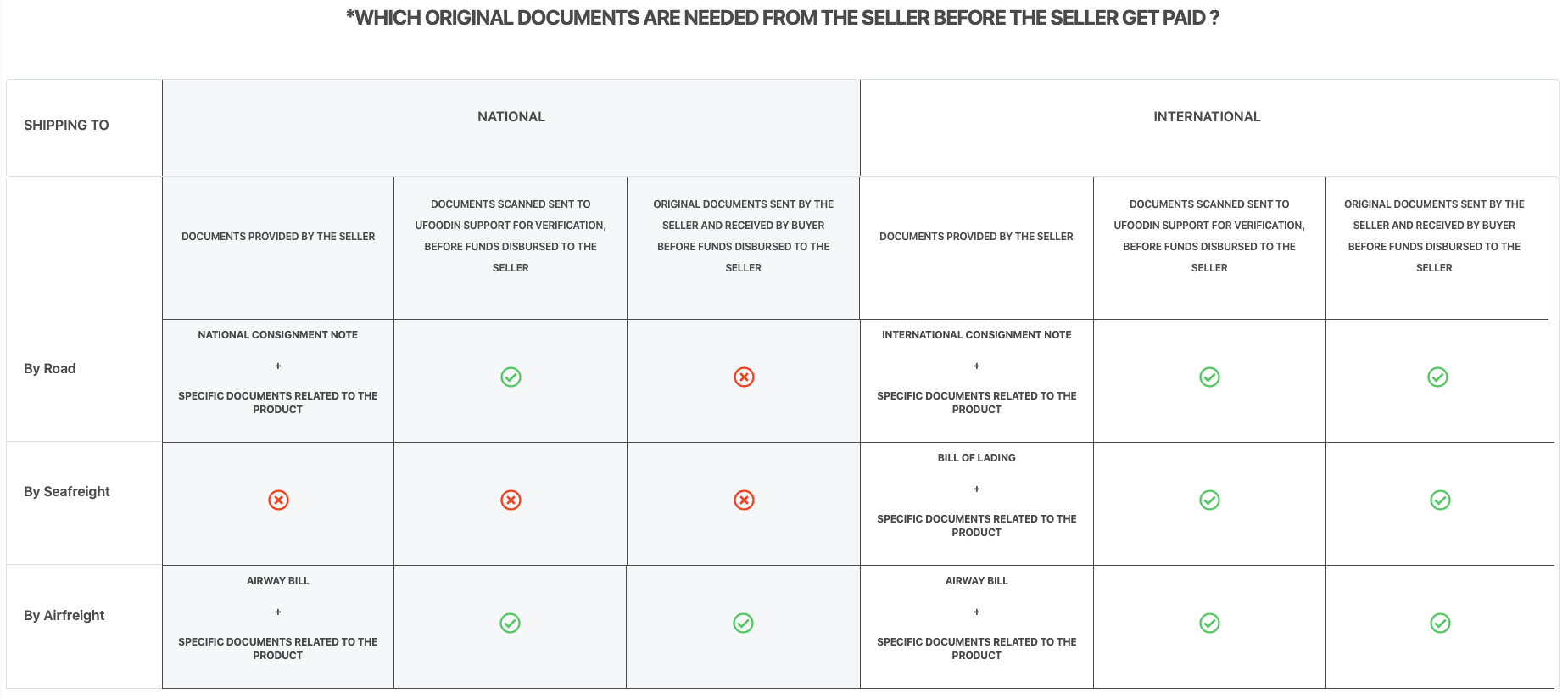

Please, find bellow the conditions to respects from the Seller, by delivering the documents scanned to uFoodin Support through the Seller Dashboard Message system, and also the original documents to provide to the Buyer before the Seller get paid*.

Once the Buyer received the original documents, within 48hours, the Buyer need to declare it to the Seller and Marketplace support to let proceed uFoodin to initiate the Supplier Payment. Got to “Orders”, enter in the Order details, and go to the section “Add a Note”. Without update from the Buyer after 48 hours after the original documents reception by mail, the Seller is in its right to request the withdrawal of the global amount of the order.

6.10- uFoodin Zero Tolerance Policy

uFoodin will investigate and may immediately suspend Seller privileges pending our investigation of any of the following buyer-reported incidents:

-

Fraudulent or offensive behavior (including information on your account, communication between you and uFoodin, communication between you and customers, and your behavior on the buyer property or designated service location).

-

Illegal activity in the course of performing your product sell or services.

6.11- Account Closure and Membership Refund

In alignment with our commitment to maintaining a secure and trustworthy marketplace, please be advised that even after successful completion of KYC/KYB validation, our financial partner Mangopay retains the right to exercise control over Seller accounts. This control enables Mangopay to conduct periodic assessments and investigations to ensure the ongoing legitimacy of Seller activities.

Should Mangopay identify any suspicious or risky behavior associated with a Seller account during their control and assessment process, they maintain the discretion to close the account in order to uphold the security of our platform and community.

In such cases of account closure initiated by Mangopay, it is important to note that membership fees paid to uFoodin by Sellers for Starter, Silver, Gold or Gold-LC Membership (Month, Annual or Lifetime plans) are non-refundable. We advise all Sellers to carefully review our terms and conditions, including this clause, before engaging in business activities on our platform.

This measure has been put in place to prioritize the safety and well-being of all participants within our marketplace, ensuring a secure and thriving environment for both Buyers and Sellers. Your understanding and cooperation are highly appreciated as we collectively strive to maintain the integrity of our platform.

If the supplier choose a monthly or annual plan (depending of the current plans offer of uFoodin), and if the supplier decided to stop the membership plan, its E-store and Products will be deleted automatically on the platform.

If there is any free trial with the membership, and the supplier decided to stop the membership plan before to start to pay the membership, its E-store and Products will be deleted automatically on the platform.

7- UFOODIN LOGISTIC & SHIPPING SERVICE

uFoodin offer a Logistic & Shipping Service through the platform.

uFoodin work with external shipping partner. The quotation will given to uFoodin come from this partner.

How it works ?

Buyer can request a Shipping Quotation through the platform in the following two cases :

1- First case: the buyer will purchase a Product from a Seller on uFoodin B2B Marketplace. The Buyer will proceed to the Shipping Quotation Request through the form on the Product Offer Page

2- Second Case: the Seller of the Product is not Seller on uFoodin B2B Marketplace. The buyer request the Shipping Quotation for a contract out of the platform

In both cases, uFoodin will send an Online Shipping Quotation to the Buyer, that it can accepted or rejected, through the platform, through the button on the email notification, or through the button the PDF Quotation.

If the buyer (client) accept the quotation, the buyer will pay directly the Quotation online, by Credit Card or by Bank Transfer to uFoodin.

Then uFoodin confirm the Shipping booking with its Shipping partner.

All the Shipping Booking through uFoodin will come with a full goods insurance.

uFoodin obliges the buyer to take out insurance of the goods on the whole of its value at a minimum.

Responsibilities

In case of dispute (delay, product degradation…), uFoodin will give to the Buyer the direct contact of the Shipping Company to process to the claim, to settle the dispute.

uFoodin will not intervene in the dispute, and does not hold itself responsible for any problem of delay, cancellation, change, deterioration of the goods during its delivery.

The compulsory insurance included covers the value of the goods during the process of transporting the goods.

8- MARKETPLACE PAYMENT SERVICE

9- MARKETING & COMMUNICATION PACKAGES

Marketing & Communication Package for Sellers:

As part of our Marketing & Communication Package for Sellers, uFoodin offers a comprehensive array of services tailored to elevate your Company & Product Offers. Our dedicated Editorial Team will craft a bespoke article spotlighting your offerings, which will be disseminated via email to our extensive network of uFoodin Members and Buyers. Furthermore, the article will be prominently featured on the “News” page of uFoodin and shared across our social media platforms, including Linkedin and Facebook.

Additionally, upon your entry onto the B2B Marketplace, our team will embark on a two-month content creation journey, during which we’ll produce a suite of promotional materials. This includes the creation of four new visuals showcasing your products, a captivating Welcome Video for the Marketplace, and a Presentation Video wherein you introduce your Product(s)/Company—recorded by you and expertly edited by us. These visuals and videos will be distributed across uFoodin’s platform as well as on Linkedin, Facebook, and Instagram.

Know more about the Marketing & Communication Package : click here

10- CHINA EXPORT PACKAGE BY UFOODIN

1. Services Offered: Welcome to uFoodin’s “China Export Package.” Our mission is to provide a range of services tailored to your specific needs. Within this package, we offer the following services:

- China Customs Registration for your products, categorized as GACC-I, GACC-II, and GACC-III.

- Trademark China Registration to secure and register your brand with the China National Intellectual Property Administration.

- Product Labels translation to ensure regulatory compliance.

2. Registration Timeframe: Please note that while we are dedicated to assisting you through the registration process, the timeframe for completion is subject to the relevant Chinese authorities and may vary.

3. Data Protection: We are committed to safeguarding the privacy of your personal and company data. We guarantee not to share any confidential information with third parties, except when required for your registration with Chinese authorities or trusted partners.

4. Data Usage: All data collected are used exclusively for the purpose of registering your products or brand with the competent authorities in China.

5. Responsibilities and Registration Rejections: In the event that any registration included in the “China Export Package” is rejected by the relevant Chinese authorities, please be aware that uFoodin cannot be held responsible for such outcomes. Rejection by authorities will not entitle the client to claim any refund or compensation from uFoodin. We are committed to guiding you through the registration process, but the ultimate decision rests with the authorities, and we cannot guarantee the success of every application.

In the event of rejection by the Chinese authorities for China Customs Registration or Trademark China Registration, additional costs may be incurred by the client (the company requesting the registration) to proceed with modifications or updates necessary to pursue final registration approval.

Please note that we are unable to provide an estimate of potential additional fees in advance, as they depend on the specific issues encountered and the processes that uFoodin and its partners must follow to address the requests of the authorities.

11- DISPUTE RESOLUTION & CONDITION

- DISPUTE RESOLUTION : In case you and uFoodin are in law dispute, the applicable law will be in the country of uFoodin Headquarter. The competent law court will the one of uFoodin Headquarter country.

- CONTRACT CONDITION: This contract is the only one we have together.

12- CONTACT

For any subjects, complains, suggestions, questions, you can contact us by our contact form here.

Privacy Policy

PRIVACY POLICY

You are visiting the web page ufoodin.com owned by uFoodin SAS, subsidiary of uFoodin Group SAS, with registered address at 128 Rue La Boetie, 75008, Paris, France and, with VAT Number FR76913519799 and SIREN Number 913519799 registered in the R.C.S Paris.

DATA WE COLLECT FROM YOU

- Data from your Registration & Profile settings

When you create a uFoodin account you need to fill your e-mail, password name, last name, username, birthdate.

When your account is created, you can fill your Profile information. All these additional information’s are optional, but highly recommended to be found by other members, and optimize your experiences on our website. By filled your Profile Information, you will have more chance to develop your network, partnership, and get more job opportunities.

If you want fill the bellow informations, please go your “Profile settings” → “Edit Profile” → “About Me” & “Company Informations”

Optional Informations: Activity Sector / Company Name / Job Title / Job Department / City / Country / Region / Gender / Company Address

- Data from your post and uploading

We collect data from your post and uploading as : Submit a Resume, fill out a Job Application, submit a Product Offer, create a Company Page and your contact address book if you synchronize it.

- Data from Membership Purchase and Profil Verification

If you register for a Membership Service as Business Membership, or apply to make verify your profile, you will need to provide payment (e.g., credit card) and billing information.

- Other data we can collect

You and others may post articles, comments, videos, photos of you on our Services. Public information of you from professional related news or other kind of publication can be available on our Services by a tag with your name.

We may receive your personal data from other when they import or synchronize their address book or calendar on our Services, send messages through our Services and associate your contact with your uFoodin Profile.

We receive data about you when you use some other services provided by us, as make in favorites a company page, product offer, job offer.

If you use our internal message services with other members, we collect information when you send & received message.

- Data collected when you use our Service

When you login on your website or apps, make search, install/update our apps, share contents…

- Data from your post and uploading

We collect data from your post and uploading as : Submit a Resume, fill out a Job Application, submit a Product Offer, create a Company Page and your contact address book if you synchronize it.

- Other data we can collect

You and others may post articles, comments, videos, photos of you on our Services. Public information of you from professional related news or other kind of publication can be available on our Services by a tag with your name.

We may receive your personal data from other when they import or synchronize their address book or calendar on our Services, send messages through our Services and associate your contact with your uFoodin Profile.

We receive data about you when you use some other services provided by us, as make in favorites a company page, product offer, job offer.

If you use our internal message services with other members, we collect information when you send & received message.

- Data collected when you use our Service

When you login on your website or apps, make search, install/update our apps, share contents…

We use cookies (See the Cookies Policy bellow), your device information and your IP (Internet Protocol) to identify you, and know your login location. (e.g., IP address, proxy server, operating system, web browser and add-ons, device identifier and features, cookie IDs and/or ISP, or your mobile carrier). If you use our Services from a mobile device, that device will send us data about your location based on your phone settings. We will ask you to opt-in before we use GPS or other tools to identify your precise location.

HOW UFOODIN USE YOUR DATA

- Services

uFoodin Platform offer opportunities to create & develop a professional network in the Food Industry. Members can connect to each other. It may help to get new partnership and business opportunities. Job seekers can find Job offers and apply to it. Members will have access to various content and market news of their activity sector. Each member can define their connection and message privacy settings.

We use your data to help you to find new connections with other members from your activity sector, your location area, by your address book (if you have sync it) by Network suggestions.

We use your data to let you know about news, events and other topics that match with your profile,

If you have submit a Resume, we may use your data to recommend you new opportunities.

- Our Membership Services

Our Membership Services help paying members to access to different functionalities.

- Business Membership allowed users to have access to the Seller Dashboard of the Marketplace of uFoodin. This membership allow to publish unlimited Product/Service Offers on the Marketplace and manage sells on it. They also have access to the uFoodin Ultimate Chat and uFoodin Drive functionalities

- Our Ads Placement Services

We sell to our members the Ads Placement on our website/App

- Profile Verification

With the one time fee Profile Verification service, we will ask you to send us a Business Card or a national ID or Passport or a Driving licence to verify your uFoodin Personal Account, and mark it with the badge “Verified Member”

- We communicate with you

uFoodin could reach you through email, mobile phone, notices posted on our websites or apps, messages to your uFoodin inbox, and other ways through our Services, including push notifications.

We may send you messages concerning, the update of our: security, policies, services.

- Advertising & Marketing

We use various data from Members and Visitors to create custom audience to display advertising. We may use the following data to optimize the advertising: Data from the cookies, Device Information, advertising tags, personal information (e.g activity sector, job title, country, city, age…) provided by you, data from your use of our Services (e.g, events participation, advertising clicks…)

You can choose your Ads Preferences and Consent change consent

To advertising our Services Offers, as Membership, Ads Publication, we may use Members’s Data and content, and show to your network connections you are using our Services.

uFoodin platform will display Ads with the label “Sponsored Consent”. If you comment, like or share the Ads, uFoodin members can see your action in their Activity Feed.

- Improve your Experience on our website

To develop our Services and offer you the best experience on our Platform, we may use your data to make research to improve your network connection, interactions, navigation, and to develop your business opportunities and career.

You may also receive survey from us, its optional to answer, but you have the opportunity to give your opinion, and it could help us to ameliorate your experiences on our platform

Trough our Customer Support we use your data investigate, resolve potential issue reported.

- Global Information

We may use your data without identify you to create our statistics such as your Localization, Activity Sectors, Job Sectors or other information’s, and help us to see a global number of members with the defined data have view, click on our clients Ads.

- Security

We may use your data for potential fraud prevention and offer the security on our platform. With the data we may investigate and avoid potential fraud and violations.

We use data for security, fraud prevention and investigations

HOW UFOODIN SHARE YOUR INFORMATION

- Your ActionsYour actions as your posts, comments, messages, likes and follows can be view by other members.For your Posts, you have the choice to select who can view it before to publish it. Your membership in groups is public, and is display on your profile page. If you want to hide it, you can change the visibility in your “Profile Visibility” settings in your Account Settings.When you follow/connect with a person or join a social group, this action is viewable by other members and the owner of the social groupWe inform members when you consult their profile. You can modify it in your Visibility SettingsWhen you share, like or comment the post/content of other, they are inform of itOther ServicesWe will use your personal data internally between our Services, to develop better our Services. We will work on Service (covered in our Privacy Policy) to improve the functionalities and you experience on our website. For example we can suggest you: new Network Connections, Job Offers, Product Offers, Social Group, Company Pages…We may use other external Services to manage the maintenance, audits, fraud prevention, payments, marketing of our Services.They may have basic information about you but are legally restricted to use it.Legal DisclosuresIn case of law request from legal jurisdictions, we may share your data to answer to the law.It could be for suspected or illegal activities investigation, to verify if the agreement between you and us is respected, claims from or allegations from third party, to protect the security and integrity of our services, to protect the uFoodin rights and safety,If possible, we may inform the member of the law request on its data, unless if the law or court doesn’t allow us.In case of new Company Controller

If our business is sold partially or totally to other, we will need to share your data with the new business controller, but all our Services should continue to respect this Privacy Policy.

YOUR DATA CHOICES & OBLIGATIONS

- All your Data is kept by our Services until you decide to close your account. Once your account is closed, your data will be totally deleted with 30 days in our side.The only cases we may need to keep your data is to answer to claims, disputes, law enforcement, fraud suspicions or other request by law and court.If you choose to suspend temporarily your account, we still keep all your data information, in case you back to use again our Services, you will find all your information intact, and you will be able to use our Services as before.You can ask us to import your data. Please consult the Help pageYou can manage and control all your data visibility on your Account Settings.Visitors can consult the Help page, and have to know they may control all of their information Visibility on our website.For any doubt do not hesitate to use the contact form to contact us.

OTHER INFORMATION

- Direct Marketing & Do Not Track Signals.We do not share any information of you without your consent for any type of Marketing actions

- Consent & Lawful basesYou can change at anytime all your Consent of Cookies and Ads : change consent. At anytime you can change the visibility of your information’s and profile in your Account Settings.If you do not consent to our Privacy Policy you may have choice to do not open an Account on uFoodin, or if you change your mind after have open an account, you have the choice to delete it at anytime.We only use your data in accordance of the Lawful bases.Security of our ServicesOur website is accessible only by a protocol HTTPS, that protecting your data. We use different defense software to avoid attack and any security issue.However, we cannot warrant the full security because of regular attacks and vulnerability. We cannot warrant that your data should not be accessed, disclosed, altered, or destroyed by breach of any of our physical, technical, or managerial safeguards.Contact uFoodinFor any subject you can contact us the Contact Form here or by Physical mail on this address: uFoodin SAS, 128 Rue La Boetie, 75008 Paris

COOKIES POLICY

COOKIES CONSENT PREFERENCES :

We and our partners store or access information on devices, such as cookies and process personal data, such as unique identifiers and standard information sent by a device for the purposes described below. You may click to consent to our and our partners’ processing for such purposes. Alternatively, you may click to refuse to consent, or access more detailed information and change your preferences before consenting. Your preferences will apply to this website only. Please note that some processing of your personal data may not require your consent, but you have a right to object to such processing. You can change your preferences at any time by returning to this site or visit our privacy policy.

Our Cookies

Cookie is a small file that uFoodin placed onto your device (computer, tablets, mobile) that enables uFoodin features and functionality. Cookies are received by any browsers that visiting our website. Cookies may from us, or thirdparty, as our partners or service providers.

uFoodin can display ads or tags to external website and can placed cookies of uFoodin on it.

uFoodin use persistent and session cookies :

The persistent cookies lasts beyond the current session and allow to recognize you as an existing user. Its help user to have easier connection experience when they back to our uFoodin.

The sessions cookies last only the time of your session

uFoodin also use tracking technologies : mobile advertising IDs and tags

How uFoodin use Cookies :

All Cookies preferences except the necessary ones of the website, can be change

- For the Authentications : Our website use cookies to recognize users when they visit our Services

- For the Security : To avoid malicious activity or violations of our Terms & Conditions, we use cookies to secure our Services

- For the Functionalities : To improve your uFoodin experience we use cookies.

- For Ads : uFoodin display personalized Ads in accordance of your profile. You can manage it in your Consent Setting

- For Analytics & Research : To provide you the better experiences on our website, we analyze the Ads impact on uFoodin. We share this information with our Ads customers. You can select your preferences on Consent Settings.

- For Cookies Consent : To let you change at anytime your Cookies consent we use cookies plugin.